Driver Risk Management System (DRMS)

Does your company suffer from....?

- Many vehicle accidents and unnecessary maintenance, and an increased exposure of employees to risks...

- A deficiency in the systems that regulate work processes within the organization according to the required quality standards.

- The recurring problems for the drivers, leading to low morale.

- An increase in the rate of injuries among the drivers.

- An increase in the administrative and operational expenses for the vehicles.

- Increase in fines and registered vehicle violations.

- The management's lack of awareness of what is happening in the organization and the workplace environment.

- Weakness in productivity, loss in sales, and business disruption.

- An annual increase in vehicle insurance premiums and deductible rates.

- Frequent traffic accidents in the company's vehicle fleet.

Driver Risk Management System (DRMS)

The Driver Risk Management System has been developed in cooperation with the Swedish National Authority (Sweroad) in the Swedish Government to create an effective system that reduces the annual losses to which transport companies are exposed as a result of the risk factors that arise from drivers and vehicles due to traffic accidents and violations

Based on its preparation of Driver Risk Management System, Roadslink Middle East Training and Consulting obtained the Innovation Award from the Insurance Authority – United Arab Emirates.

Driver and Vehicles Risk Management System is essential in order to identify, manage and control risk to drivers and to company vehicles assets and reducing the large financial losses incurred by the company as a result of the risks surrounding this aspect.

The most effective approach is to implement an integrated Risk Management System that combines managing and enhancing the security and safety of drivers and reducing high costs at the same time.

Management plays a crucial role for Driver Risk Management (DMS). Management will set the standards and create policies for professional driver risk prevention, which is immediately followed by financial losses incurred by the company.

Driver Risk Management System enables the Roads and Transport authorities and relevant companies in the fleet performance monitoring to be able to set levels risk is in each company separately and reduced and control it.

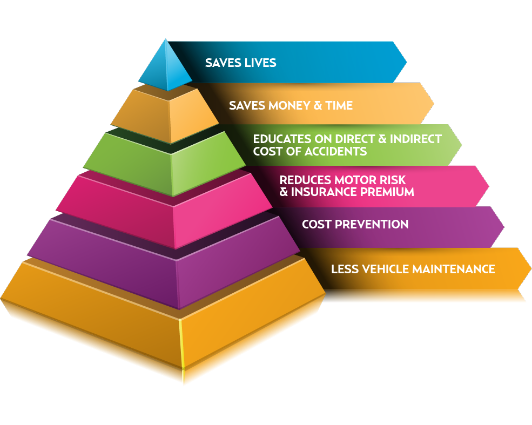

Economic and operational benefits of implementing the Driver Risk Management System (DRMS):

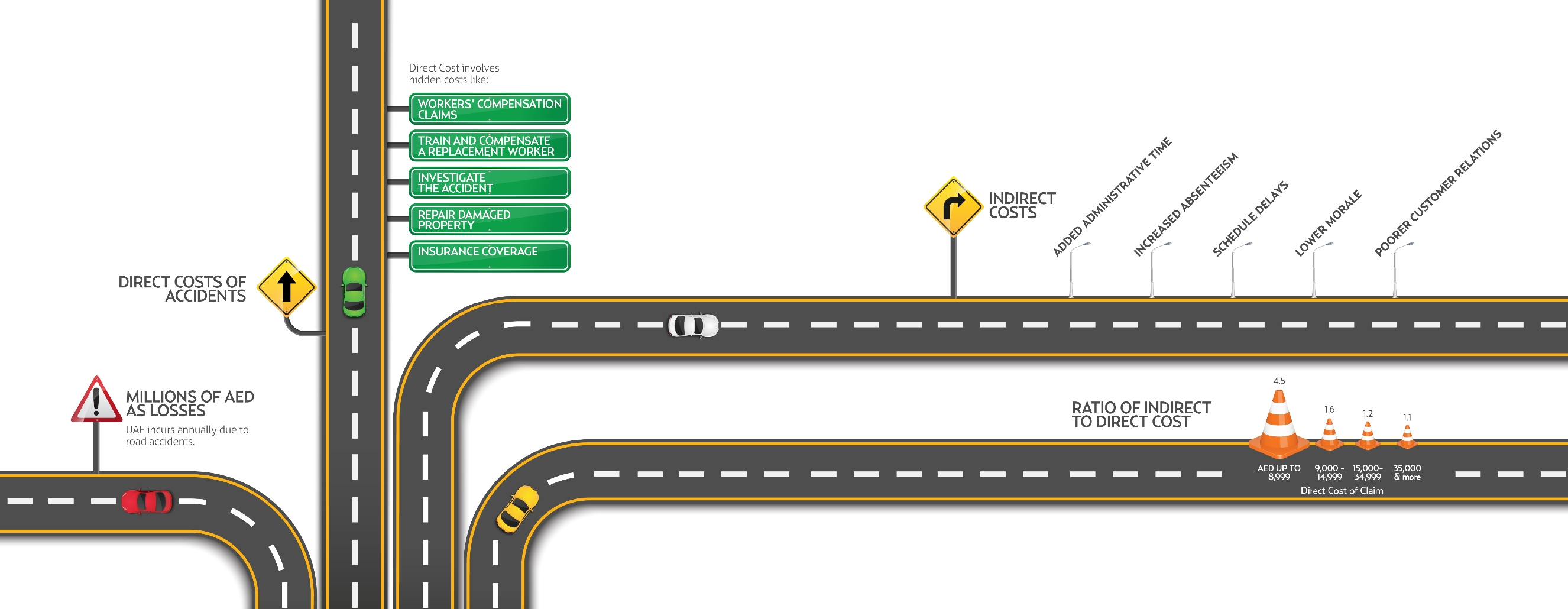

- In addition to the human costs incurred, there is a significant cost associated with activities related to vehicle collision accidents, which actually cause property damage. The absence of a Driver Risk Management System effectively contributes to an increase in insurance premiums, the burden rate per accident, unnecessary maintenance costs, and an increase in employee exposure to risks.

-

The Driver Risk Management System contributes to reducing:

- Direct financial costs: High insurance premiums and burden rates, vehicle repair costs, costs of work stoppage, and decreased productivity.

- Indirect financial costs: New hires to replace old employees, fines and court costs, social and medical care fees, costs of injury to any external party, vehicle breakdown and reduced productivity, investigation of administrative accidents, and damage to reputation.

- The Driver Risk Management System helps reduce claims and high insurance premiums related to increased accident rates, increases employee and customer satisfaction, reduces exposure to risks, decreases operational costs, and improves the operator's reputation.

-

Each collision accident incurs various other associated costs, in addition to the physical damage to the vehicle, such as:

- Injury costs.

- Disruption of productivity.

- Sales loss.

- Damaged customer relations.

- Negative company image.

- Administrative expenses (fleet management).

- Legal fees.

- Extra and/or uninsured costs.

- Fines.

-

Transportation companies that own fleets incur a lot of expenses.

To reduce these expenses, they need a Driver Risk Management System. - The Driver Risk Management System contributes to improving fleet operations, reducing expenses , and creating a safer and more productive fleet.

-

The Driver Risk Management System is universally recognized as a practical and realistic system for use. When a company uses this system, it will significantly reduce:

- High insurance premiums and the burden rate for accidents.

- Injury costs.

- Fines.

- Accident costs, such as vehicle repairs.

- Loss in vehicle and driver productivity.

- Sales loss.

- Damaged customer relations.

- Negative company image.

A company that uses the Driver Risk Management System will receive a highly reliable brand recognition from its customers and achieve the expected level of quality.

General indicator

General indicator

Drivers

Drivers

Control

Control

Information Technology

Information Technology

Management

Management

Quality assurance

Quality assurance